Ethereum and Bitcoin See Transaction Fees Plummet Amid Market Downturn

TLDR

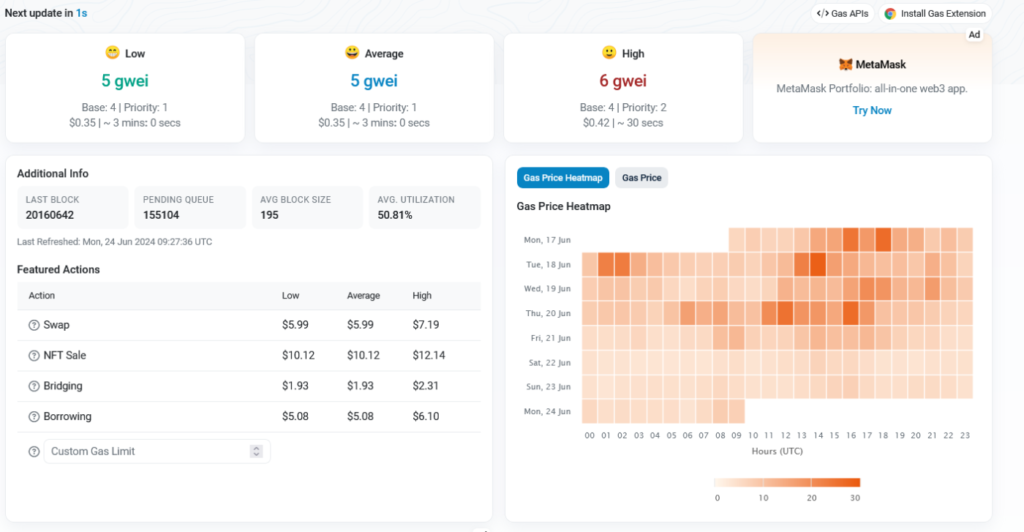

- Ethereum gas prices have dropped significantly, with the average price at 7.32 Gwei as of June 21, 2024, down from higher levels earlier in the year.

- Layer 2 (L2) solutions on Ethereum are experiencing record-high activity, helping to reduce congestion on the main chain.

- Bitcoin transaction fees have also decreased, reaching $1.93 per transaction on June 23, the lowest level since October 2023.

- The low fees on both networks are attributed to increased efficiency, particularly due to L2 adoption on Ethereum, rather than a decrease in overall network activity.

- These low fees come during a period of market downturn, with Bitcoin falling below $63,000 and many altcoins experiencing double-digit losses.

Ethereum and Bitcoin are experiencing a significant drop in transaction fees, reaching multi-month lows despite high network activity.

This comes as the broader cryptocurrency market faces one of its most challenging weeks in 2024, with Bitcoin dropping below $63,000 and many altcoins suffering double-digit losses.

Ethereum has seen its gas prices – the cost to conduct transactions on the network – plunge to levels not seen in years. The average gas price on Ethereum stood at just 7.32 Gwei, a dramatic decrease from 98.68 Gwei recorded on March 5. This drop makes the network significantly more affordable for both developers and users.

The reduction in Ethereum gas fees is particularly noteworthy given the high level of network activity.

According to data from L2Beat, Ethereum Layer 1 and Layer 2 protocols recorded an average of 299 transactions per second on June 21. This paradox of low fees and high activity is largely attributed to the increased adoption and efficiency of Layer 2 (L2) solutions.

L2 solutions, designed to enhance Ethereum’s scalability, process transactions off the main Ethereum chain, thereby reducing congestion and costs. The widespread adoption of these protocols reflects their critical role in easing network traffic and lowering gas prices.

As noted by Pistachio.fi founder Brian Smocovich,

“The L1 gas market is now more efficient because most volume is on L2s, L2 -> L1 settlement is 100x cheaper than pre-4844, and we have the gas market efficiencies of EIP-1559.”

ethereum volume per day is the same if not higher than 6 months ago. L1 fee market is now more efficient because of L2 volume and EIP4844. https://t.co/faW4hlIln4 pic.twitter.com/mjU8uyXFIk

— bsmokes.eth (@BSmokes_) June 24, 2024

The impact of these efficiency gains is clearly visible in the cost of common transactions. For instance, performing a swap on Uniswap now costs just $1.06, trading an NFT on Seaport costs $1.49, and transferring ETH on-chain costs a mere $0.23. When using L2 networks like Base, which incorporates “blob” transactions, these fees are reduced even further, with a Uniswap swap on Base costing just $0.0016.

However, the dramatic reduction in gas fees has also led to a decrease in Ethereum’s burn rate, which is now at a 12-month low. This has caused Ethereum’s supply to turn slightly inflationary, with a growth rate of around 0.56% per year according to ultrasound.money.

Bitcoin is experiencing a similar trend in transaction fees. On June 23, the average Bitcoin transaction fee reached $1.93, its lowest level since October 2023. This marks a significant decrease from the fee spikes often seen during periods of high market volatility or price appreciation.

The low fees on the Bitcoin network are particularly interesting given the historical context. Every major bullish period since 2012 has typically resulted in a corresponding increase in fees, with the notable exception of the 2021 bull run. During that period, Bitcoin’s price touched $69,000, but transaction fees remained relatively low.

The current low fee environment for both Ethereum and Bitcoin comes at a time when the broader cryptocurrency market is experiencing significant turbulence.

Bitcoin’s price has fallen below the $63,000 support level, while many altcoins have seen double-digit percentage losses.

This market downturn has led to billions in liquidations from leveraged positions, while spot holders have also incurred heavy losses.

Despite the market turmoil, the low transaction fees on both networks represent a silver lining for users and developers.

Lower fees make these blockchain networks more accessible and cost-effective for a wide range of applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs) and beyond.

The post Ethereum and Bitcoin See Transaction Fees Plummet Amid Market Downturn appeared first on Blockonomi.