Bitcoin (BTC) Price Prediction: BTC/USD Faces Another Rejection as Bitcoin Retraces to $60k

Bitcoin May Fluctuate Between $58k and $63k as Bitcoin Retraces to $60k – October 30, 2021

Today,

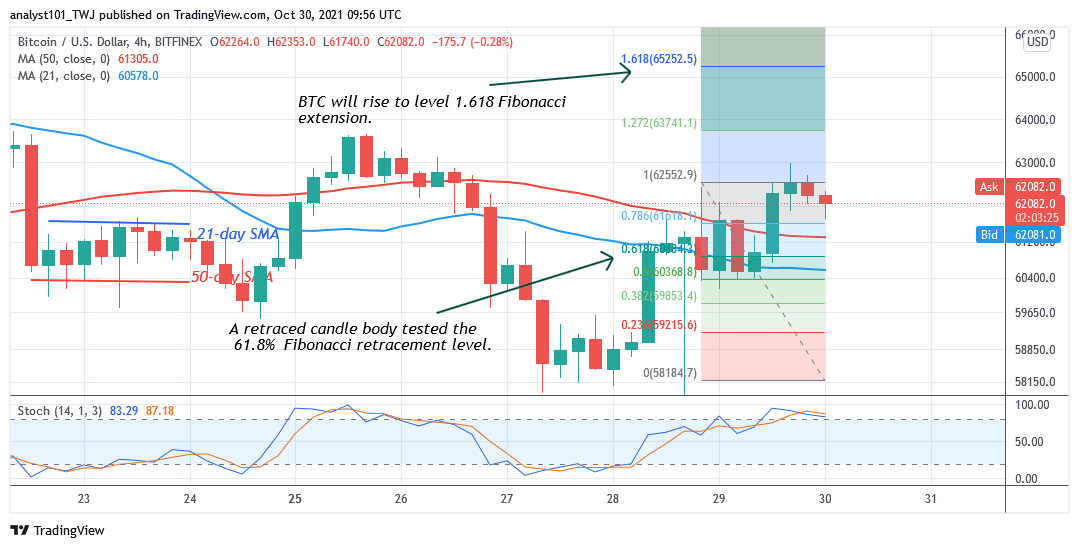

Bitcoin’s upward move is facing rejection at the $63,000 resistance zone. In the first resistance, the market declined to the $61,000 support and resumed consolidation above it. Today, buyers are facing stiff resistance as they attempt to breach the resistance level. If the bulls breach the recent high, the market will rally above the first major resistance level of $64,000. The momentum will extend to retest or break the $67,000 overhead resistance. A breakout above the overhead resistance will catapult Bitcoin to trade above the $70,000 psychological price level. Conversely, where BTC prices fail to break through the resistance levels, Bitcoin will be compelled to a sideways move. The market will fluctuate between and $58,000 and $63,000 price levels. Bitcoin is currently trading in the overbought region; therefore the upward move is doubtful.

Bitcoin (BTC) Indicator Reading

Bitcoin is at level 58 of the Relative Strength index period 14. The cryptocurrency is in the uptrend zone and above the centerline 50. The king coin has room to rally on the upside. The price bars are above the 21-day line moving average which indicates a further upward move. The crypto is above 80% area of the daily stochastic. It indicates that Bitcoin is in the overbought region of the market. Sellers will emerge in the region to push prices down. It will cause the cryptocurrency to decline.

Today, BTC/USD is in a minor retracement at the $63,000 resistance as Bitcoin retraces to $60k. There are indications of further upward moves of the cryptocurrency. Meanwhile, on October 28 uptrend; a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement indicates that Bitcoin will rise to level 1.618 Fibonacci extension or $6,5252.50.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider