Starting With Cryptocurrency Trading? 5 Tips to Follow

Cryptocurrencies are like a trader’s Disneyland. Investors are wary of risky assets, but volatility bodes well for traders because it offers them more opportunities to initiate trades.

As cryptocurrencies mature, they’ll likely become more stable. That doesn’t leave traders with any fewer options though. Dozens of cryptocurrencies emerge every year; 30 new cryptos were introduced just during the past month as of this writing. Though some of them will wither over time, they’ll allow traders to play ball as long as they’re actively traded.

Even if the emergence of new crypto coins slows down, the most established cryptocurrencies in the world themselves are far from becoming mature. Consider Bitcoin, Ethereum, or Ripple for instance. All of them have been around for a while, but all of them go through massive price swings often.

The ample trading opportunities have prompted many to take up trading. Seasoned equity or forex traders, college students, or even those who lost their job to a pandemic, are trying to profit from the uncertainty in the crypto market. As new players on the crypto field, they could use a couple of trading tips to get a good start.

5 Tips to follow when trading cryptocurrency

Before initiating their first trade, traders should spend a couple of minutes educating themselves about the landscape of the cryptocurrency market and learn the best trading practices. Evidently, trading cryptocurrencies, though the same in principle as trading equities, requires a slightly tweaked approach.

The most important thing to understand about crypto trading is that it’s unregulated, unlike equity or forex trading. The volatility of the crypto markets makes backpedaling a near-impossible task so it’s best to test the waters by starting slow. To that point, the following are a couple of tips crypto investors could use as they trade.

1. Sign up with a good crypto exchange

Since the crypto market is unregulated, scammers roam free and look for naïve newcomers that are willing to choose an exchange without screening for credibility. In the past, a few established exchanges have scammed their users as well. Americans lost $80 million to crypto scams over the past six months; some scams could’ve been averted by just doing due diligence.

A trader will essentially deploy the entire capital through the crypto exchange. Selecting a good exchange isn’t just about convenience and payment or withdrawal options, it’s also about security. Always choose an exchange that a trustworthy person can vouch for and has first-hand experience with.

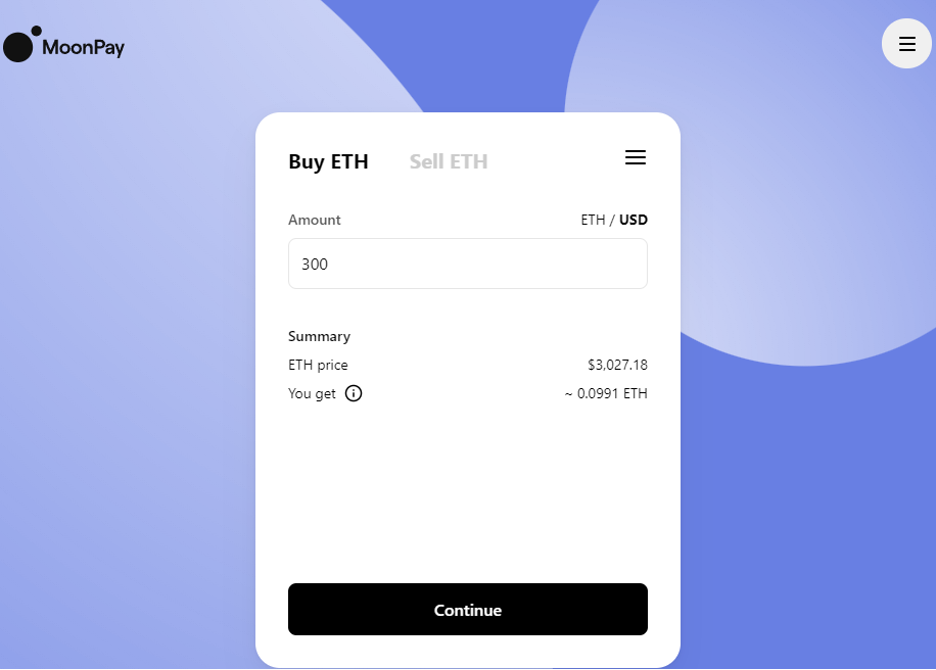

Of course, an asset’s price among exchanges doesn’t differ enough to cause concerns. For instance, a trader can buy Ethereum on MoonPay for the same price as on any other exchange. What differs is the modes of payments or withdrawal available and security.

There’s a whole section on security-specific tips below, but for now, it’s important to understand just how important it is to choose a good exchange. If the exchange goes defunct, traders lose their entire capital, which means shutting shop or in some cases, bankruptcy.

2. Learn the basics of risk management

Traders make money by taking risks. Risk is intertwined with the concept of trading; risk-free trading is an oxymoron and aiming for it is a futile attempt. While eliminating risk is out of the question, traders will do themselves a favor by learning the basics of risk management.

Risk management is even more important when trading cryptocurrencies because there’s little room for correcting mistakes once a trade is initiated.

The starting point of risk management involves simply being prudent about how traders approach systematic risk. For instance, relying on a tip and investing a good portion of the capital in a single asset is like entering the jungle asking for a predator to prey on you. If the asset’s price behaves unexpectedly, the trader will end up losing a lot of money.

This also ties into the next risk management best practice—diversification. Traditional wisdom advises not to put all eggs in one basket. When one basket vanishes, traders will lose a couple of eggs, but will have more eggs in other baskets.

When a trader bets a large sum on a single asset and the price plummets, the investor will likely lose a lot more capital than if they had invested the same amount in several, uncorrelated assets.

The uncorrelation is what ties into the final risk management best practice—hedging. Hedging is like insurance. When a trader takes an extremely risky bet that they have good reason to believe will play out as anticipated, they can minimize the risk by hedging.

Hedging involves purchasing an Options contract (a derivative contract) to either buy or sell an asset which gives the trader an option, but not the obligation, to buy or sell a particular asset at a predetermined price. This way, the trader can cap their net loss if the trade doesn’t play out as expected.

3. Security

In addition to exchanges, there’s a lot a trader should consider in terms of security. The first step is to get a good cold wallet. Hot wallets (i.e., wallets that have internet access) are vulnerable to attacks from hackers. A cold wallet is a physical device that keeps a trader’s private keys safe.

Cold wallets store the keys inside an impenetrable circuit and offer one-click transaction signing functionality. They also have a seed, which enables traders to import private keys into another wallet in the event of theft or loss of the device.

It’s also crucial to avoid public Wi-Fi and use a VPN to encrypt the data being transmitted from the device. A cybercriminal could use a man-in-the-middle attack to intercept the information while it’s being transmitted on an insecure network. If a trader is connected to public Wi-Fi without a VPN, the criminal will be able to easily steal the information.

As a rule of thumb, it’s best to avoid public Wi-Fi. This shouldn’t be a big problem since most smartphones now have a hotspot functionality anyway. It’s also important to keep the hotspot network secure, though.

To make things airtight, use two-factor authentication (2FA). 2FA is a standard practice for adding an extra layer of security for validating transactions. It makes a criminal’s job harder because now they have two passwords to break through instead of just one. Most standard exchanges now enable 2FA by default since it’s an extremely important element of a trader’s overall security setup.

4. Research methodology

A trader’s research methodology is a whole different game than an investor’s methodology. Investors need to gauge the asset’s fundamental strength because they’ll need to stick it out for the long term. An asset that isn’t promising in the long term or has no tangible value proposition is a terrible choice for an investor.

On the contrary, traders have very little to do with a company’s fundamental strength because they’re generally trading to pocket gains in the short term, often within minutes of initiating the trade. This is why volatility works in favor of traders. The faster the price moves after they initiate the trade, the quicker they can generate profits.

Traders play on market sentiment. If the market believes that Dogecoin should be worth $0.45, the price will likely move towards $0.45 at least for the time being. It’s possible that the price may correct soon after, but by the time they do, the traders will be smiling their way to the bank. Investors though will still have their funds deployed in the asset.

5. Take your time

Traders begin trading on day one and find themselves buried in trades on day five. This is, in most cases, suicide. Trading requires experience. Any trader who believes they have become a money-making machine after a dozen successful trades are headed for disappointment. The markets take away from traders more quickly than they give.

Traders, especially new ones, should take things slow and get themselves familiarized with the lay of the land before going full throttle. It’s important to realize that trading is a high-risk activity. A small mistake can come with a big cost. Any time that a trader doesn’t feel confident about a trade, it’s best to just let it pass and monitor how it would have played out so they have a reference for the future.

Ready to trade?

Once the trader has sincerely considered these tips, they’re more likely to stick it out for the long haul in the trading game. Trading is almost an art form though. Markets are unpredictable, but with some experience, traders can build an instinct mechanism that helps them navigate the uncertainty efficiently.

In the meantime, it’s good to keep trying out strategies to see what works best and what doesn’t. Not all trading styles work for all investors, of course.

It’s also important to realize that the strategies traders find online can backfire if directly deployed. It’s advisable to test the strategies out and learn from experience. Over the next 12 months, these efforts will compound and make a novice trader an expert.

|

Author: Arjun Ruparelia Email – ruparelia.arjun@gmail.com An accountant turned writer, Arjun writes financial blog posts and research reports for clients across the globe. Arjun has five years of financial writing experience across verticals. He is a CMA and CA (Intermediate) by qualification. |